First, to be clear – TaTaTaCrypto is not a financial advisor and you are solely responsible for the currencies you choose to invest in. Please do your research.

The Cryptoportfolio that TaTaTaCrypto has chosen as a portfolio to hold for at least 1-2 years consists of 11 different currencies. About half of the portfolio’s initial value is invested in Bitcoin and Ethereum. The other 9 currencies included in the portfolio are distributed equally with 5% content each.

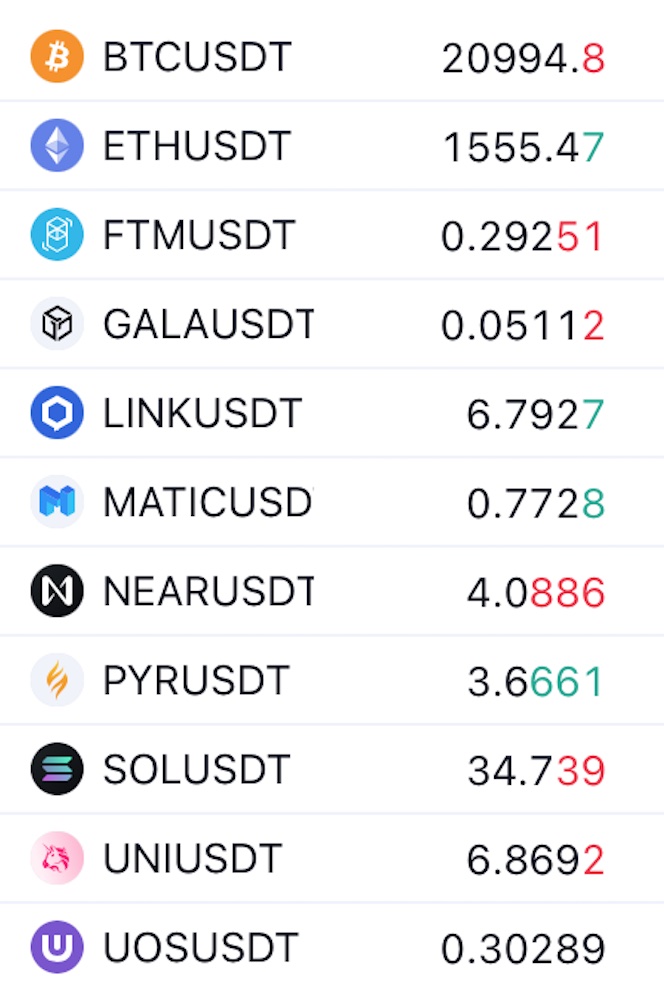

TaTaTaCrypto Portfolio 2022 (August)

- 30 % Eheterum

- 25% Bitcoin

- 45 % Other (9 x 5 %)

The portfolio is balanced between Smart Contract platforms, ecosystems (ETH/SOLANA/NEAR/FTM) and Gaming currencies (GALA/PYR/MATIC/UOS). LINK is an Oracle that blockchains “can’t do without” that sends data between different blockchains and is actually included in all Crypto categories.

Bitcoin and Ethereum are the currencies that have the least risk of failure, and therefore have the largest % share in the portfolio.

The table below shows the currencies included in the portfolio, as well as which of them are available for purchase on Binance and Kucoin.

Monitor your Portfolio in Tradingview

If you want to have full control of your crypto portfolio and the currencies you invest in, you can save them in a watch list in Tradingview. There you can follow your entire portfolio in real time, as well as analyze courses with lots of different indicators RSI, moving average, volume, FIB levels etc.

Gaming/Metaverse Portfolio

For those who believe that Gaming and Metaverse are the hottest sector in the coming year, we have ranked the 10 cryptocurrencies we think will perform well in that area. Cryptogaming is high risk project and it is possible to make big profits but also catastrophic losses. Volatility is high and cryptocurrencies can lose a lot in a short period of time, so be extremely careful in your research before investing in a Gaming cryptocurrency. The timing is also important, as some gaming currencies have questionable tookonomics. Unequal distribution of the currency between e.g. developers, heavy investors and “ordinary buyers”. Some currencies also have such a currency economy/tookenomics that they risk being affected by inflation. For example. can founders/developers and financiers for a certain pot of currencies that they have to hold, allocate, a certain time, e.g. 1 year, then they can sell the currency. When the allocation time has expired, there may suddenly be lots of sellers who want to take home their winnings.